Debt is an integral part of modern financial systems, but it can significantly affect an individual’s financial health. Various types of debt exist, including credit card debt, student loans, mortgages, and personal loans, each carrying unique implications. Credit card debt, often characterized by high-interest rates, can accumulate rapidly, leading to a cycle of borrowing that is hard to escape. On the other hand, student loans, while often seen as an investment in one’s future, can impose a long-term financial burden that impacts other aspects of life, such as home purchases and retirement savings.

Mortgages are another common form of debt, allowing individuals to purchase homes but potentially anchoring them to substantial monthly payments for decades. Lastly, personal loans, typically used for urgent financial needs, can add another layer to an individual’s debt burden, especially when multiple loans are acquired simultaneously. The diversity of debt types suggests that financial strategies need to be tailored based on the nature and terms of each debt.

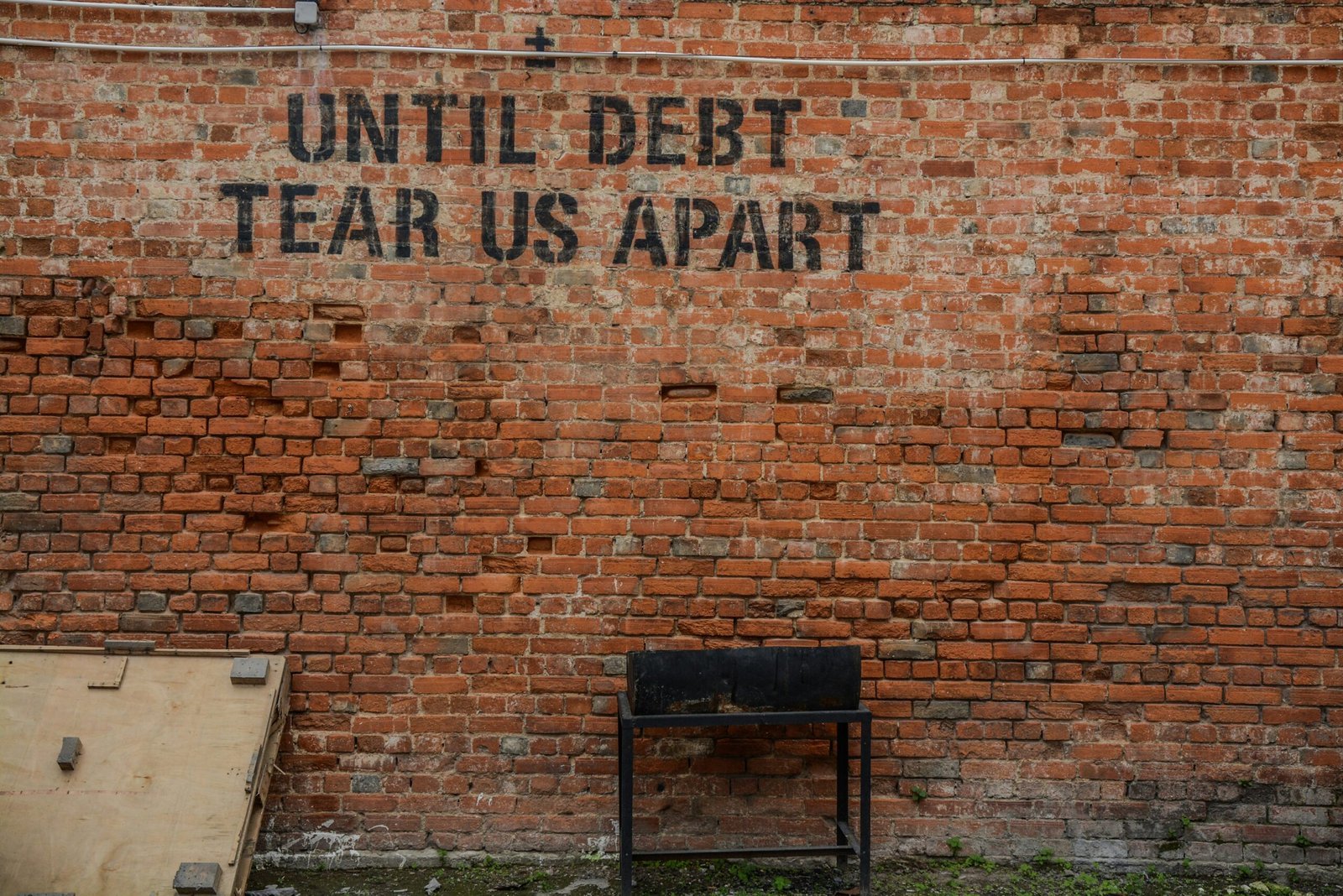

The impact of debt extends beyond mere numbers. Psychologically, carrying debt can lead to stress, anxiety, and feelings of inadequacy, affecting mental health and overall quality of life. Individuals may find themselves limiting personal or professional opportunities due to financial constraints, resulting in a cycle of debt and missed chances for investment and growth. Moreover, debt can adversely affect credit scores, which play a crucial role in securing loans, renting properties, and overall financial stability. Lower credit scores can lead to higher interest rates, making borrowing even more expensive and further entrenching individuals in their debt. Understanding the nuances of these financial obligations is essential for anyone aspiring to achieve a debt-free lifestyle and build sustainable wealth.

Eliminating debt is a critical step toward achieving financial freedom, and adopting effective strategies can significantly influence the outcome. Two popular methods for debt repayment are the snowball and avalanche approaches. The snowball method entails paying off the smallest debts first, gaining momentum as each balance is eliminated. In contrast, the avalanche method focuses on high-interest debts, minimizing the total interest paid over time. Both approaches have their merits, and individuals can choose based on their personal motivations and financial situations.

Creating and adhering to a detailed budget is another essential strategy. A budget helps individuals identify their income, expenses, and discretionary spending. This clear picture enables one to allocate more resources toward debt repayment while still managing necessary living costs. Building an emergency fund is equally important; having this financial buffer can prevent individuals from accruing additional debt due to unexpected expenses.

Negotiating with creditors can also yield beneficial results. Many creditors are willing to work with borrowers, providing options such as lower interest rates or modified payment plans. Such negotiations can make a significant difference, especially for those facing financial strain. Additionally, exploring debt consolidation options may prove advantageous. By consolidating multiple debts into a single loan with a lower interest rate, individuals can simplify their repayment process and lower their total monthly payments.

Prioritizing debt repayments is crucial. One should assess their debts, focusing efforts on those with the highest interest rates or smallest balances, depending on the chosen repayment strategy. Regularly tracking progress is paramount; this not only provides motivation but also enables individuals to make necessary adjustments to maintain focus on their goals. With these effective strategies in place, individuals can take decisive steps toward eliminating debt and establishing a sound financial future.

Once individuals have successfully eliminated their debt, the next critical focus should be on wealth-building strategies that can secure financial stability and foster long-term growth. This transition from debt clearance to wealth accumulation is pivotal in achieving financial independence. One of the primary methods of building wealth is through disciplined saving and investment practices. Establishing a habit of saving a portion of income consistently lays a solid foundation for future investments.

Setting clear financial goals is essential; these could include short-term objectives like creating an emergency fund or long-term aspirations such as purchasing a home. Goals help to maintain focus, ensuring that savings and investments are strategically aligned with one’s financial aspirations. Additionally, leveraging retirement accounts—like 401(k)s and IRAs—can be an effective strategy to build wealth over time. Contributions to these accounts not only provide tax benefits but also compound savings over the years, promoting significant growth.

Investing in the stock market is another avenue for wealth accumulation, as it offers the potential for higher returns compared to traditional savings accounts. Understanding the risks and devising a diversified investment strategy can help mitigate risks while maximizing returns. Furthermore, building multiple streams of income can significantly enhance financial security and expedite the wealth-building process. This might include side businesses, freelance work, or investments that generate passive income, such as rental properties or dividends from stock investments.

Finally, maintaining a balanced approach to spending and savings is crucial post-debt repayment. This includes being mindful of discretionary spending while ensuring that investment and savings goals are met. By prioritizing both savings and informed spending habits, individuals can secure their financial future while enjoying the benefits of a debt-free lifestyle.

Transitioning to a debt-free lifestyle is a significant achievement; however, it necessitates ongoing commitment and discipline to maintain this newfound financial freedom. One of the fundamental strategies for sustaining a debt-free existence is adherence to a well-structured budget. By meticulously tracking income and expenditures, individuals can identify areas where they can save or allocate funds more effectively. This practice not only promotes financial awareness but also aids in preventing unnecessary overspending, which can lead to debt accumulation.

In addition to budgeting, the importance of financial education cannot be overstated. Educating oneself about personal finance principles equips individuals with the knowledge needed to make informed financial decisions. Understanding the concepts of interest rates, investment options, and savings strategies can empower individuals to make sound choices that promote wealth-building. Regularly engaging with financial literature, workshops, or online courses can significantly enhance one’s financial literacy, paving the way for long-term wealth creation.

Avoiding lifestyle inflation is another critical factor in maintaining a debt-free lifestyle. As income increases, it can be tempting to upgrade one’s living standards or indulge in luxury items; however, resisting this urge is essential. Instead of automatically elevating expenses, individuals should focus on prioritizing savings and investments, ensuring that their financial foundation remains strong. Consumerism can be a significant barrier to financial health, as the relentless pursuit of material possessions can detract from saving and investing.

Ultimately, adopting a proactive mindset towards financial management is vital for sustaining a debt-free lifestyle. Embracing minimalism and prioritizing financial goals can help foster a culture of saving and responsible spending. Utilizing tools and resources for continuous monitoring of one’s financial health, such as budgeting apps and financial advisory services, can also support this ongoing commitment. By integrating these strategies into daily life, individuals can ensure their path to wealth-building remains uninterrupted.